Goodbye Allstate and State Farm. Americans Choosing GEICO and Progressive for new car insurance policies

A new study by J.D. Power, in collaboration with TransUnion, reveals that Progressive and GEICO were the biggest winners in the American auto insurance industry Q2 of 2021. The Quarterly Shopping List Report examines car insurance quote and switch rates.

GEICO had the most quote volume among the leading insurance companies. Allstate came in second with Progressive and State Farm capturing the third and fourth positions, respectively.

GEICO remains popular in the Northeast, South and West where it retains its position as the most-quoted insurer in Q2. Progressive is tops in the Southern U.S.

Progressive has captured the most business from defectors who have decided, for one reason or another, to switch insurers. The company has now gained 45.2 percent market share over the last five years.

In that same time period, The Hartford has seen its market share decrease the most, losing 35.3 percent. Other losers include Nationwide (down 35.1 percent), Farmers (down 16.9 percent), and State Farm (down 12 percent).

J.D. Power

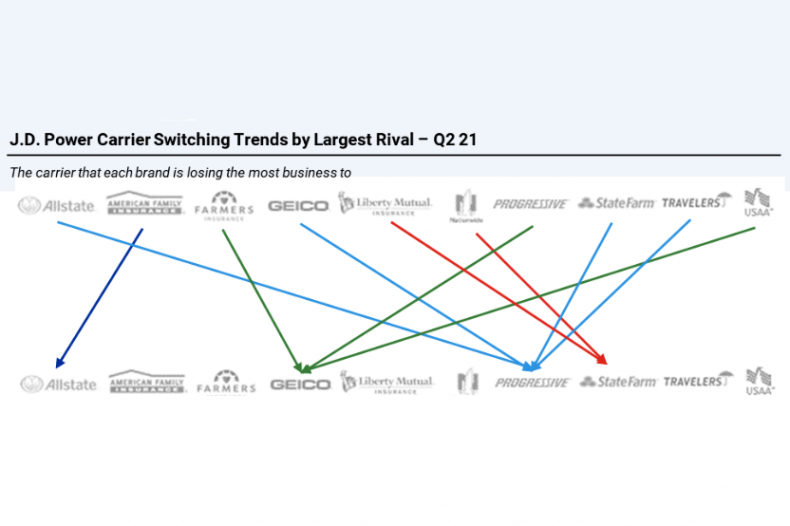

Customers of Allstate, GEICO, State Farm and Travelers were most likely to switch to Progressive. American Family Insurance policy holders regularly moved to Allstate while Farmers, Progressive, and USAA clients switched to GEICO. State Farm contested business from Nationwide and Liberty Mutual.

USAA, Amica, The Hartford, Kemper, Nationwide and State Farm had the most customer loyalty in the second quarter of 2021. National General, ACG, Progressive, SafeCo and Auto Owners insurance have the least loyal customers.

Post-pandemic, American’s car buying habits are getting back into full swing. Though the semiconductor chip shortage has cut output from plants, many buyers are purchasing vehicles before or as soon as they arrive on dealership lots.

American’s driving habits are also changing as new drivers gain licenses, workers resume their commutes into the office, and travelers hit the road. These changing habits, along with purchases of new vehicles are giving buyers a reason to shop for the best rates. J.D. Power believes that “tremendous pent-up consumer demand” will “continue to have implications on auto insurers” through Q3 and Q4.

0 Commentaires