Big insurance broker merger, related deals in jeopardy as DOJ intervenes

The U.S. Justice Department’s move to block Aon PLC’s planned merger with Willis Towers Watson PLC stands to have wide-ranging implications for many players in the insurance brokerage industry.

The department filed a lawsuit June 16 that alleged the transaction would violate antitrust laws and “eliminate substantial head-to-head competition and likely lead to higher prices and less innovation.” In its complaint, the DOJ said the planned merger “would be likely to substantially lessen competition” in five markets: property and casualty and financial risk for large customers; health benefits; actuarial services for large, single-employer defined benefit pension plans; private multicarrier retiree exchanges; and reinsurance broking.

While Aon proposed certain divestitures to address antitrust concerns, the DOJ said it “failed to propose remedies sufficient to preserve competition in all of the relevant markets alleged.”

Aon and Willis Towers Watson said the DOJ’s position “reflects a lack of understanding of our business, the clients we serve and the marketplaces in which we operate.”

Craig Wildfang, a partner at Robins Kaplan LLP, expects the insurance brokers to at least begin the process of fighting the Justice Department in court.

“The fact that the DOJ had to actually file the action suggests to me that the divestitures that DOJ is seeking are sufficiently serious that the parties would rather at least dip their toe in the water of litigation before capitulating and selling off business units that they probably think are important,”

Wildfang said in an interview.

Ray Lehmann, executive editor and senior fellow at the International Center for Law and Economics, said the insurance industry needs to innovate to fill the gaps in insurance coverage globally, which requires “some firms with scale and expertise across a broad range of industries and geographies.”

Lehmann said the deal should play out, and if it proved to create “a genuine antitrust concern, a genuine restraint of competition,” then the government could get involved with a remedy.

The lawsuit casts significant doubt on whether the deal, which was first scheduled to close in the first half of the year and later pushed back to the third quarter, will make it to the finish line. Prior the DOJ’s announcement, the prospects of the merger closing were seen as “very likely,” according to Keefe Bruyette & Woods analyst Meyer Shields.

“There’s certainly more uncertainty because there are still other regulators that we haven’t heard from and they may have their own individual concerns,” Shields said in an interview.

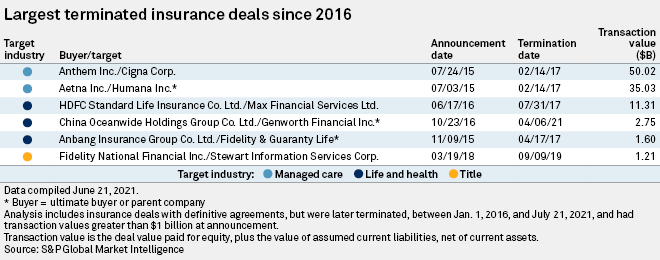

The last time the DOJ got involved in transactions that sought to merge some of the biggest names in the insurance world, it successfully blocked two proposed marriages between what were then four of the five-largest publicly traded managed care companies. The eventual terminations of the Anthem Inc. and Cigna Corp. merger, as well as Aetna’s deal with Humana Inc. became the largest insurance deal cancellations in this century.

Knock-on effect

Arthur J. Gallagher & Co. agreed to acquire the bulk of the companies that Aon and Willis plan to sell to satisfy competition regulators, but the deal is contingent on the merger going forward. Further delays to the deal between Aon and Willis “clearly is not in the favor of the three parties that are trying to do this transaction,” CEO Patrick Gallagher said during an investor call.

Delays could also lead to a talent drain from the merger partners. The longer the situation lingers, the greater the chance employees will look for opportunities elsewhere, according to Shields.

“The real strength in these broker units is the people who still work there, and they don’t know where they’re going to end up, be it Aon or someplace else,” the analyst said. “There are dozens of companies that would actually want to hire the best talent from Willis Towers Watson, and they’re going to do that. So even if [Aon] wins, it’s not a great victory, and if they lose, they have much less to sell.”

A collapse of the planned takeover stands to have implications for the wider industry. Piper Sandler analyst Paul Newsome noted that all of the announced divestitures related to the deal are contingent upon the merger closing. A secondary issue, Newsome said, is whether a change will take place in the regulatory environment.

“It’s too early to tell. We’re in new territory here because we’ve never seen a merger of this size between brokers,” Newsome said in an interview. “The majority of insurance mergers are dependent upon state regulators, and the vast majority of insurance brokerage acquisitions are too small and rarely turn into an antitrust issue.”

The DOJ intervention could prompt Aon to offer more units for sale. Wildfang said the government’s lawsuit seeks to either block the transaction entirely or require divestitures that would leave “at least three significant players” in several relevant markets.

Under the existing sale agreement, Aon can offer Arthur J. Gallagher additional business with revenue up to $200 million. Gallagher said Arthur J. Gallagher was “wide open” to this and “very well inclined to take on more of their business.”

0 Commentaires